Friday, February 27, 2009

Crude Oil / Gold rally imminent

A week ago, the Gold/Oil ratio hit a high of 26, the highest it has been since 1999... meaning that Oil was the cheapest it has been in terms of real money for the past decade!

Last week... priced in Dollars we saw Oil prices gain about 11% while Gold dipped 5%, and the Gold/Oil ratio now stands at 21. It is clear to me that a major breakout in Oil is beginning to take place.

Historically, the Gold/Oil ratio has always come back to 10 and last year it hit a low of 7. However, because I believe we are about to see a run on the U.S. Dollar and a rush into Gold, it is my thinking that Gold could deserve a large monetary premium over Oil and it is possible that the Gold/Oil ratio will only return to 15.

A return to a Gold/Oil ratio of 15 means Oil could rise from its current price of $44.76 per barrel, up to about $62.79 per barrel, which would be a 40% gain in the price of Oil.

However, because I believe Gold is soon going to $1,500 to $2,000 per ounce, it wouldn't surprise me to see Oil once again reach $100 to $133 per barrel in 2009.

The world's oil reserves that have been discovered are declining at a rate of 6.7% per year so unless a huge amount of new Oil is soon discovered, in 15 years there won't be any Oil left at any price.

-----

Jonathan Lebed

Lebed.biz

Staff

Thursday, February 26, 2009

Wednesday, February 25, 2009

Greeks shut airports, services to protest economy

Public schools and tax offices shut down, and services at ministries and public offices were suspended, as hundreds of workers marched to parliament with banners reading "No to pension reforms, privatisations and job cuts".

"Government policy ... only burdens workers, the unemployed and the poor," public sector umbrella union ADEDY, which represents 500,000 members, said in a statement.

The strikes are the latest in a wave of protests that have put pressure on Greece's conservative government, shaken by the worst riots in decades in December and struggling with a sharp economic downturn.

After years of 4 percent growth, Greece is seeing its economy sharply slowing down due to the global financial crisis. Workers accuse the conservative government, clinging to a one-seat majority in parliament, of only helping the rich.

"We will continue and intensify our struggle, until our demands are satisfied," ADEDY, which called the 24-hour strike, said.

National carrier Olympic airlines [OLY.UL] said 68 of its domestic and international flights were cancelled and four were rescheduled, while private rival Aegean Airlines (AGNr.AT) said 36 flights were grounded and 23 others disrupted.

The government, struggling with a huge public debt and fiscal deficits, has launched a 28-billion-euro ($36-billion) bank support plan, saying it meant to pour money into the slowing economy.

The strike was the latest in a series of public protests to hit the ruling conservatives. December riots were prompted by the police shooting of a teenager but fuelled by discontent over the economy and high youth unemployment.

In January, thousands of farmers protesting low product prices blocked border crossings, causing 11 days of travel chaos across Greece and hurting commercial transport. They ended the protest after securing a 500-million-euro aid package.

Truckers went on strike last week, demanding a crackdown on unlicensed transport companies and illegal economic immigrants, who they said were destroying goods and fighting drivers in their effort to stow away on board.

On Wednesday, they ended the five-day strike and blockades at the borders with Bulgaria and Greek ports, after transport ministry officials promised to start talks.

"Our strike is over, but only for now," said the president of Greek truck drivers federation, Apostolos Kenanides.

source

Tuesday, February 24, 2009

Sunday, February 22, 2009

Saturday, February 21, 2009

Up to 120,000 people march in national protest

Ictu maintained that the protest today was the first step in a campaign in support of a fairer way to achieve economic recovery.

Addressing the demonstration Ictu general secretary David Begg said that “a business elite” had destroyed the economy and had not yet been held to account for it in any respect.

Mr Begg called on the Government to talk to the trade union movement on its alternative ten-point plan for economic recovery.

He said that Ictu’s ten-point plan was not perfect but that it was the best offer that it would get “and if you are sensible you will engage with us and talk to us about it.”

He said that no balance had been put forward by the Government in its solutions for dealing with the current economic crisis. He said that there was no sense of a sharing of the burden right across the economy "not alone that it should be shared by the people who were best able to bear it and who had done best in the Celtic tiger years”.

The president of Ictu, Patricia McKeown, said that the Government wanted workers who built the economy to make the sacrifices while it protected those who wrecked it.

“We are not prepared to live in that society,” she said.

Ms McKeown said that the time had come for Irish workers to demonstrate to the Government the power they really held.

“That power is today on the streets of Dublin, it is in industrial action but most significantly it is at the ballot box.

“If our Government and the elected politicians are not prepared here and now to pledge that they will act now and act on our behalf and act on the proposals we have placed before them then you must be prepared to deny them even a single vote and to send that message out loud and clear,” she said.

Mr Begg said that the reputation of the country had been almost irreparably damaged by what had been done so far.

Continue Reading

Soros: Economic Turbulance Worse Than Great Depression

Soros said the turbulence is actually more severe than during the Great Depression, comparing the current situation to the demise of the Soviet Union.

He said the bankruptcy of Lehman Brothers in September marked a turning point in the functioning of the market system.

"We witnessed the collapse of the financial system," Soros said at a Columbia University dinner. "It was placed on life support, and it's still on life support. There's no sign that we are anywhere near a bottom."

His comments echoed those made earlier at the same conference by Paul Volcker, a former Federal Reserve chairman who is now a top adviser to President Barack Obama.

Volcker said industrial production around the world was declining even more rapidly than in the United States, which is itself under severe strain.

"I don't remember any time, maybe even in the Great Depression, when things went down quite so fast, quite so uniformly around the world," Volcker said.

source

Friday, February 20, 2009

Latvia's Government Collapses

The government in Riga, faced with forecasts of a severe drop in the economy this year, was the first in Eastern Europe to succumb to turmoil caused by the crisis. Its collapse rounded out a week that saw worries about feeble investment, banks and output in Central and Eastern Europe coursing through international markets.

Latvia has had a history of revolving-door politics and complex coalitions since pulling free of the Soviet Union in 1991. Prime Minister Ivars Godmanis, who presented his resignation to President Valdis Zatlers on Friday, had been in power only since December 2007. But the precipitous plunge of Latvia's economy, which helped provoke the worst riot since 1991 last month, played a major part in the government's downfall.

Continue Reading

Racial Warfare erupts on French Caribbean island on economy

Trouble broke out on the island earlier last month after protesters began rioting over high prices and low wages.

But the situation escalated this week after protesters began turning on rich white families as they demanded an end to colonial control of the economy.

The troubles come at the height of the holiday season, with thousands of mainly British, French and American tourists on the paradise tropical island.

Guadeloupe descends into full-scale urban warfare after demonstrators riot over low wages and white control of the island's economy

Violence has escalated on the Caribbean island as protesters turn their attention to rich white families who they blame for their poor standard of living

Protesters were now targeting 'all white people', with the media in mainland France describing the situation as virtual civil war'.

Guadeloupe is a French overseas department ruled directly from Paris, and authorities in France have sent 300 extra riot police to the island in a bid to quell the violence.

Meanwhile, hundreds of protesters are roaming the streets of the capital Point-a-Pitre, looting shops and restaurants, burning cars and vandalising public buildings.

Continue Reading

Volcker: Crisis May be Even Worse than Depression

Volcker noted that industrial production around the world was declining even more rapidly than in the United States, which is itself under severe strain.

"I don't remember any time, maybe even in the Great Depression, when things went down quite so fast, quite so uniformly around the world,'' Volcker told a luncheon of economists and investors at Columbia University.

Given the extent of the damage, financial regulations must be improved and enhanced to prevent future debacles, although policy-makers must be cautious not disrupt things further while the turmoil is ongoing.

Volcker, a former chairman of the Federal Reserve famed for breaking the back of inflation in the early 1980s, mocked the argument that "financial innovation,'' a code word for risky securities, brought any great benefits to society. For most people, he said, the advent of the ATM machine was more crucial than any asset-backed bond.

"There is little correlation between sophistication of a banking system and productivity growth,'' he said.

He stressed the importance of preventing financial institutions large enough to pose a threat to the entire system from engaging in risky behavior such as running hedge funds or trading for its own accounts.

The current crisis had its beginning in global imbalances like a lack of savings in the United States, but policy-makers around the world were too reticent to take action until it was too late, Volcker said.

Now that the crisis had erupted, it was important to take decisive actions, including a more effective regulatory structure and some movement toward uniform accounting systems, Volcker said.

He said all financial institutions that are deemed too large to fail should be subject to increased scrutiny, echoing the findings of the Group of 30, a panel of policy-makers and influential economists, which he leads.

source

Thursday, February 19, 2009

US fraud claim sparks bank panic

Customers in the Caribbean island of Antigua, Venezuela, Colombia, Ecuador and other nations besieged Stanford banks to try to withdraw money.

On Tuesday US officials raided Stanford's main offices in Houston, Texas as the US Securities and Exchange Commission (SEC) announced charges against Stanford and two of his executives for "massive fraud".

The SEC also froze Stanford's assets and those of three of his companies, Stanford International Bank, based in Antigua, and Stanford Group and Stanford Capital Management, both based in Houston.

Stanford is accused of lying about the safety of investments he sold as "certificates of deposit" (CDs) and promising unrealistically high rates of return.

Regulators also allege he forged historical data about other investments which he then used to lure in more investors for his products.

The whereabouts of Stanford, a wealthy billionaire from Texas, remain unknown, the SEC has said.

Continue Reading

Wednesday, February 18, 2009

UK "could experience a crash similar to Iceland"

Charles Gradante, co-founder of the Hennessee Group, points out that Iceland had one of the highest standards of living in the world just a few months ago, but after experiencing the fastest economic collapse in history, it is suffering from soaring unemployment as well as double digit interest rates and inflation.

Hennessee Group says there are other countries that share some of the same characteristics as Iceland, particularly with regards to its debt to economic output, and could be vulnerable to the same devastating effects of the financial crisis.

It believes it is imperative that world leaders pursue the appropriate policies to stimulate trade and promote worldwide growth so it does not enter a global economic crisis similar to that of the 1930's.

Continue Reading

China Urges U.S., Europe to Protect Value of Debt in Reserves

Feb. 18 (Bloomberg) -- China, whose $1.95 trillion in currency reserves are the world’s largest, called on the U.S. and Europe to protect the value of its overseas investments and said it plans to spend more foreign exchange on imports and acquisitions.

“We hope countries whose currencies are the main holdings in our international reserves will take effective measures to cope with the financial crisis,” Fang Shangpu, deputy director at the State Administration for Foreign Exchange, told a press conference in Beijing today. “They should work to maintain economic and financial stability, and protect the interests and confidence of investors.”

China increased its purchases of U.S. Treasuries last year by 46 percent to $696.2 billion, data released by the U.S. Treasury Department yesterday showed. Premier Wen Jiabao said on Feb. 2 his government’s Treasury strategy would be aimed at maintaining the “value” of its foreign reserves.

Tuesday, February 17, 2009

Cicero, 55 B.C.

Monday, February 16, 2009

Sunday, February 15, 2009

China considering Gold instead of US treasury bonds

Feb. 13 (Bloomberg) -- China Banking Regulatory Commission official Luo Ping said holding U.S. government bonds is not the only option for investing reserves, clarifying comments made a day earlier, the China News Service reported.

U.S. debt is one option in addition to gold and other government debt, Luo, head of the training center at the banking regulator, was quoted as saying in an interview with the news agency late yesterday. If the U.S. government issues too much debt in its efforts to revive the economy, all Treasury holders will suffer losses, he added, the Chinese-language report said.

Dow Jones on Feb. 11 cited Luo as saying that there are few real alternatives to holding U.S. Treasury securities. CBRC said late yesterday in a statement that Luo’s comments don’t represent the view of the regulator.

One more Madoff investor kills self

William Foxton, 65, who had served in the British Army and more recently worked as a defense contractor in Afghanistan, died from a single bullet wound to the head in the southern English port city of Southampton on Tuesday, police said.

"A pistol was recovered at the scene. Police do not believe the death to be suspicious," a police statement said.

His son Willard said his father had returned from Afghanistan and revealed his life savings had been lost. He did not say how much had gone, but news reports said it was close to 1 million pounds ($1.45 million).

Donald Trump Quits Trump Entertainment, Bankruptcy Possible

Feb. 13 (Bloomberg) -- Donald Trump resigned from the board of Trump Entertainment Resorts Inc., the debt-laden casino company he founded, ahead of a possible involuntary bankruptcy filing next week.

“I’m not managing it, it’s not me that’s responsible for managing,” Trump, who was chairman, said in a telephone interview today. “Unless we’re going to be responsible for management it’s just not something that’s worthwhile.”

Trump’s departure comes ahead of a Feb. 17 deadline to make a $53 million bond payment originally due on Dec. 1. The Atlantic City, New Jersey-based casino operator said at the time it needed to conserve cash and hold debt-restructuring talks with lenders. Since an initial grace period ended on Dec. 31, Trump Entertainment’s deadline has been extended four times.

The 62-year-old real estate entrepreneur has “no idea” whether there will be a bankruptcy filing, he said. Trump is “not thrilled” the company may continue to use his name.

Saturday, February 14, 2009

Friday, February 13, 2009

Revolt is in the air: Countries across Europe in turmoil

The worst economic crisis since the Great Depression is throwing countries across Europe into turmoil--and spurring struggles unseen in years.

The financial turmoil that began in the summer of 2007 in the U.S. is spreading around the globe with frightening speed and devastating consequences for working people.

The bursting of the bubble in the U.S. housing market in the summer of 2007 was the catalyst for full-blown economic crisis in country after country in Europe.

Now, the economic disaster is sparking mass protest and revolt on a scale not seen in two decades. Britain's Guardian newspaper described the new political reality in a January 31 article titled "Governments across Europe tremble as angry people take to the streets." It begins:

France paralyzed by a wave of strike action, the boulevards of Paris resembling a debris-strewn battlefield. The Hungarian currency sinks to its lowest level ever against the euro, as the unemployment figure rises. Greek farmers block the road into Bulgaria in protest at low prices for their produce. New figures from the biggest bank in the Baltic show that the three post-Soviet states there face the biggest recessions in Europe.

It's a snapshot of a single day [January 30] in a Europe sinking into the bleakest of times. But while the outlook may be dark in the big wealthy democracies of Western Europe, it is in the young, poor, vulnerable states of Central and Eastern Europe that the trauma of crash, slump and meltdown looks graver.

Exactly 20 years ago, in serial revolutionary rejoicing, they ditched communism to put their faith in a capitalism now in crisis and by which they feel betrayed. The result has been the biggest protests across the former communist bloc since the days of people power.

Europe's time of troubles is gathering depth and scale. Governments are trembling. Revolt is in the air.

China Needs U.S. Guarantees for Treasuries

The U.S. “should make the Chinese feel confident that the value of the assets at least will not be eroded in a significant way,” Yu, who now heads the World Economics and Politics Institute at the Chinese Academy of Social Sciences, said in response to e-mailed questions yesterday from Beijing. He declined to elaborate on the assurances needed by China, the biggest foreign holder of U.S. government debt.

Benchmark 10-year Treasury yields climbed above 3 percent this week on speculation the government will increase borrowing as President Barack Obama pushes his $838 billion stimulus package through Congress. Premier Wen Jiabao said last month his government’s strategy for investing would focus on safeguarding the value of China’s $1.95 trillion foreign reserves.

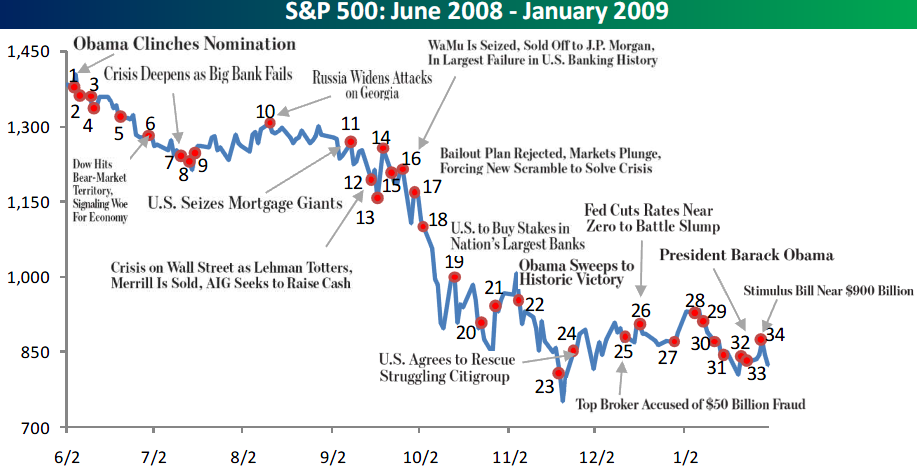

S&P 500: June 2008 - January 2009

Label Date WSJ Lead Headline

1 6/3 Obama Clinches Nomination.

2 6/7 Markets Slammed by Oil, Crude Leaps Nearly $11.

3 6/10 Big Loss At Lehman Intensifies Crisis Jitters.

4 6/11 Inflation's Bite Worsens Around World.

5 6/21 Ford Reels as Truck Sales Plunge.

6 6/28 Dow Hits Bear-Market Territory.

7 7/12 Crisis Deepens as Big Bank Fails: IndyMac Seized In Largest Bust In Two Decades.

8 7/14 Treasury and Fed Pledge Aid For Ailing Mortgage Giants.

9 7/16 SEC Moves to Curb Short Selling.

10 8/11 Russia Widens Attacks on Georgia.

11 9/8 US Seizes Mortgage Giants FNM and FRE.

12 9/15 Crisis on Wall Street as Lehman Totters, Merrill Is Sold, AIG Seeks to Raise Cash.

13 9/17 US To Take Over AIG in $85 Billion Bailout; Central Banks Inject Cash as Credit Dries Up.

14 9/20 US Bailout Plan Calms Markets, But Struggle Looms Over Details.

15 9/22 Goldman, Morgan Scrap Wall Street Model, Become Banks in Bid to Ride Out Crisis.

16 9/26 WaMu Is Seized, Sold Off to JP Morgan, In Largest Failure in US Banking History.

17 9/30 Bailout Plan Rejected, Markets Plunge, Forcing New Scramble to Solve Crisis.

18 10/4 Historic Bailout Passes As Economy Slips Further.

19 10/14 US to Buy Stakes in Nation's Largest Banks.

20 10/23 Markets Fall as Fears of Slump Span World.

21 10/28 Crisis Deals New Blow to Japan: Stocks at '82 Levels.

22 11/5 Obama Sweeps to Historic Victory.

23 11/19 Big Three Plead For Aid.

24 11/24 US Agrees to Rescue Struggling Citigroup.

25 12/12 Top Broker Accused of $50 Billion Fraud.

26 12/17 Fed Cuts Rates Near Zero to Battle Slump.

27 12/29 Israel Pounds Gaza Again, Signals More on the Way.

28 1/3 Manufacturing Tumbles Globally.

29 1/8 Corporate Scandal Shakes India.

30 1/10 Citigroup Takes First Step Toward Breakup.

31 1/15 Bank of America to Get Billions in US Aid.

32 1/21 President Barack Obama.

33 1/23 Thain Ousted in Clash at Bank of America.

USA was 3 hrs away from Economic, Political Collapse in September 2008

Transcript from 2:10

Rep. Paul Kanjorski (D)

I was there when the secretary and the chairman of the Federal Reserve came those days and talked to members of Congress about what was going on... Here's the facts. We don't even talk about these things.

On Thursday, at about 11 o'clock in the morning, the Federal Reserve noticed a tremendous drawdown of money market accounts in the United States to a tune of $550 billion being drawn out in a matter of an hour or two.

The Treasury opened up its window to help. They pumped $105 billion into the system and quickly realized that they could not stem the tide. We were having an electronic run on the banks.

They decided to close the operation, close down the money accounts, and announce a guarantee of $250,000 per account so there wouldn't be further panic and there. And that's what actually happened.

If they had not done that their estimation was that by two o'clock that afternoon, $5.5 trillion would have been drawn out of the money market system of the United States, would have collapsed the entire economy of the United States, and within 24 hours the world economy would have collapsed.

Now we talked at that time about what would have happened if that happened. It would have been the end of our economic system and our political system as we know it.

Wizards of Money

Check it out here